Apple Pay Later: A new way to pay for your purchases online

Apple has recently launched a new feature in its Wallet app that allows users to pay for their online purchases in installments, with no interest and no fees. This feature, called Apple Pay Later, is similar to other buy now, pay later services that have become popular among consumers who want to spread the cost of their purchases over time.

How does Apple Pay Later work?

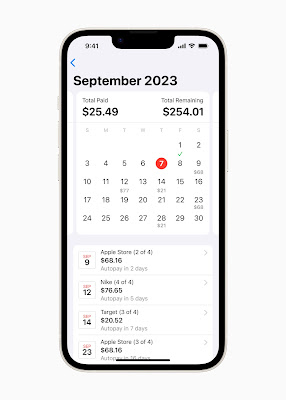

Apple Pay Later lets users split the cost of their purchases into four equal payments that are due every two weeks. The first payment is made at the time of purchase, and the remaining three payments are automatically charged to the user's debit card that is linked to Apple Pay. Users can also apply for a loan within the Wallet app, ranging from $50 to $1000, which can be used for online or in-app purchases with merchants that accept Apple Pay. The loan has no interest or fees, and users can track, manage, and repay their loans in one convenient location in the Wallet app.

Who can use Apple Pay Later?

Apple Pay Later is currently only available to users who are invited to access a prerelease version of the feature. Apple plans to offer it to all eligible users in the coming months. To use Apple Pay Later, users need to meet the following requirements:

- Be 18 years of age or older

- Be a U.S. citizen or a lawful resident with a valid, physical U.S. address that's not a P.O. Box

- Set up Apple Pay with an eligible debit card on their device

- Set up two-factor authentication for their Apple ID and update to the latest version of iOS

- Verify their identity with a driver license or state-issued photo ID

What are supporting devices for Apple Pay Later?

Users can apply for a loan in the Wallet app and use it for online and in-app purchases on iPhone and iPad. Apple Pay Later is currently available only for invited users who have either iOS 16.4 or iPadOS 16.4.

What are the benefits and risks of Apple Pay Later?

Apple Pay Later offers several benefits for users who want to pay for their purchases over time, such as:

- No interest or fees: Unlike some other buy now, pay later services, Apple Pay Later does not charge any interest or fees for using the feature. Users only pay the amount of their purchase, divided into four payments.

- Convenience and security: Users can apply for and use Apple Pay Later within the Wallet app, without having to download any additional apps or create any accounts. Users can also enjoy the security and privacy features of Apple Pay, such as biometric authentication and encryption.

- Flexibility and control: Users can choose when and how much they want to borrow, up to $1000 per loan. Users can also see the total amount due for all of their existing loans, as well as the total amount due in the next 30 days. Users can make early payments or pay off their loans at any time.

However, Apple Pay Later also comes with some potential risks that users should be aware of, such as:

- Debt accumulation: Although Apple Pay Later does not charge any interest or fees, users still need to repay their loans on time and in full. If users borrow more than they can afford or make multiple purchases using Apple Pay Later, they could end up accumulating more debt than they can handle.

- Credit impact: Apple says that using Apple Pay Later will not affect the user's credit score. However, if users fail to make their payments on time or default on their loans, Apple may report their payment history to credit bureaus, which could negatively impact their credit score and ability to borrow in the future.

- Limited availability: As of now, Apple Pay Later is only available to select users in the U.S., and only for online or in-app purchases with merchants that accept Apple Pay. Users cannot use Apple Pay Later for in-store purchases or for purchases with merchants that do not accept Apple Pay.

Conclusion

Apple Pay Later is a new feature that allows users to pay for their online purchases in installments, with no interest and no fees. It is similar to other buy now, pay later services that have become popular among consumers who want to spread the cost of their purchases over time. However, users should also be aware of the potential risks of using Apple Pay Later, such as debt accumulation and credit impact. Users should only use Apple Pay Later responsibly and within their means.

No comments: